- #Prior year tax returns irss how to#

- #Prior year tax returns irss verification#

- #Prior year tax returns irss software#

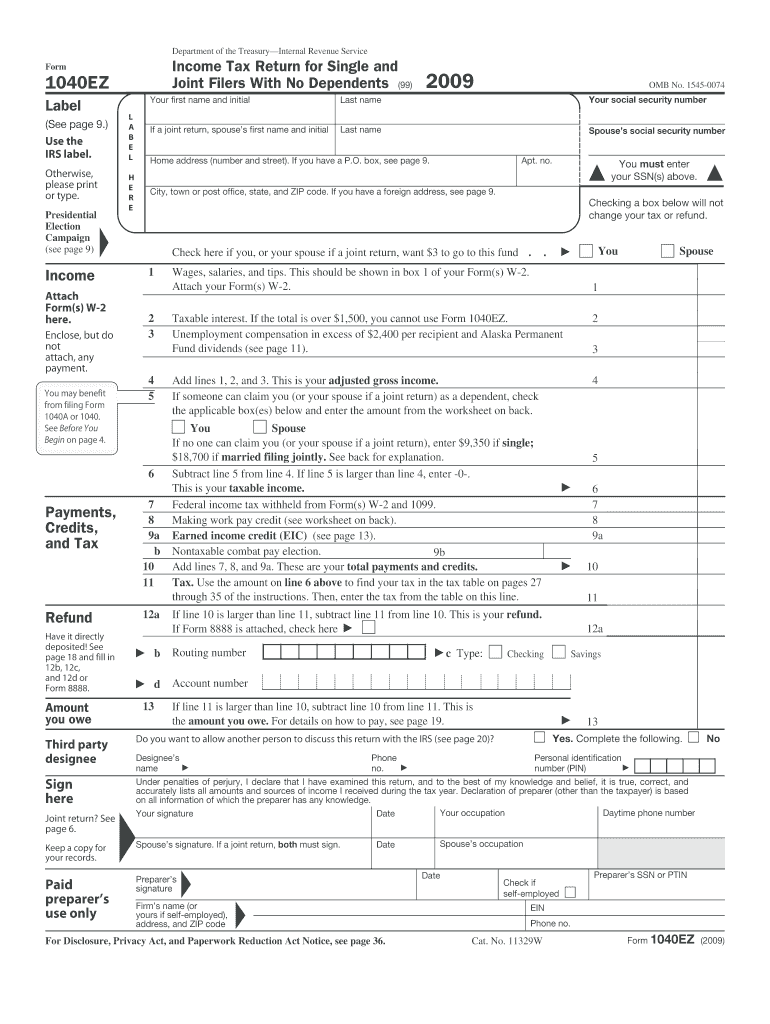

Taxpayers can complete and mail Form 4506 to request a copy of a tax return and mail the request to the appropriate IRS office listed on the form. Those who need an actual copy of a tax return can get one for the current tax year and as far back as six years. These forms are available on the Forms, Instructions and Publications page on IRS.gov.

#Prior year tax returns irss verification#

They use Form 4506-T to request other tax records: tax account transcript, record of account, wage and income and verification of non-filing. Taxpayers can complete and send either Form 4506-T or Form 4506T-EZ to the IRS to get one by mail. Courtney, Larson, continue to work with the IRS and Treasury to determine prospective eligibility. Please allow five to 10 calendar days for delivery. The December 21 letter from the IRS confirms that homeowners who have already completed repairs to their home would be able to claim the costs on their federal tax returns for 2017, or any open prior year.

Taxpayers who are unable to register or prefer not to use Get Transcript Online may use Get Transcript by Mail to order a tax return or account transcript type. Those who use it must authenticate their identity using the Secure Access process. They can use Get Transcript Online on IRS.gov to view, print or download a copy of all transcript types. There are three ways for taxpayers to order a transcript: Taxpayers who order by mail should allow 30 days to receive transcripts and 75 days for tax returns. The IRS reminds people ordering a transcript to plan ahead, because delivery times for online and phone orders typically take five to 10 days from the time the IRS receives the request. People can also get them for the past three years. They’re free and available for the most current tax year after the IRS has processed the return. A transcript summarizes return information and includes AGI. Taxpayers who cannot get a copy of a prior-year return may order a tax transcript from the IRS.

#Prior year tax returns irss software#

Those who need a copy of their tax return should check with their software provider or tax preparer first, as prior-year tax returns are available from the IRS for a fee.

#Prior year tax returns irss how to#

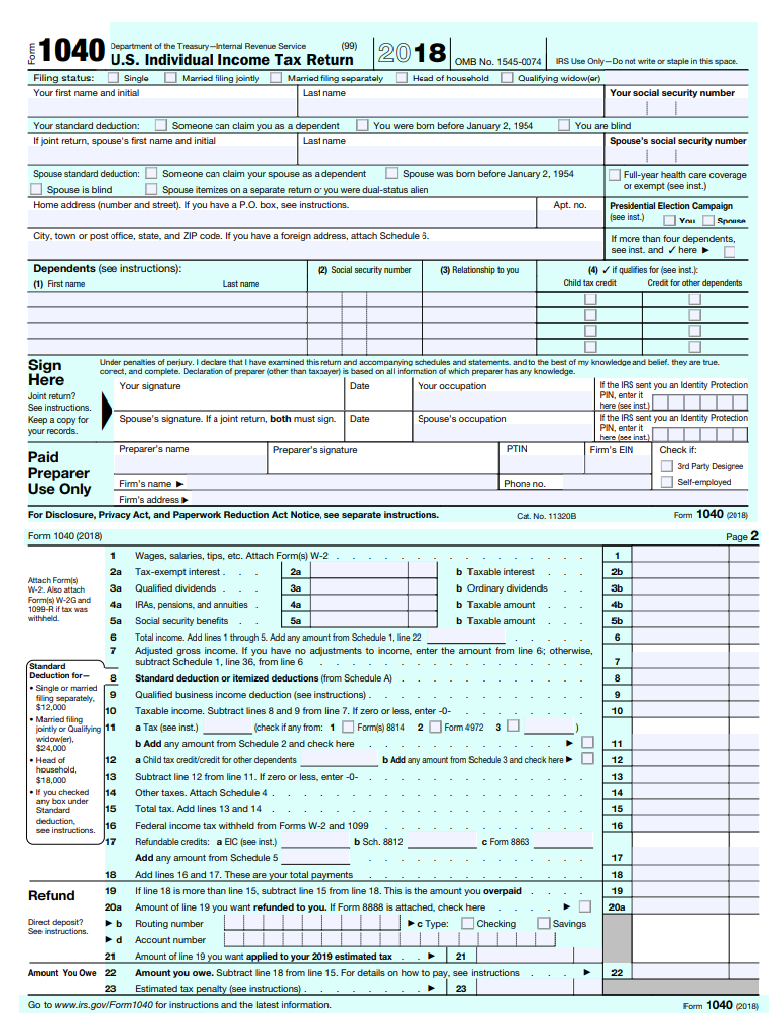

Taxpayers can learn more about how to verify their identity and electronically sign tax returns at Validating Your Electronically Filed Tax Return. Taxpayers using a tax filing software product for the first time may need their adjusted gross income amount from their prior year’s tax return to verify their identity. Taxpayers should keep some documents - such as those related to real estate sales - for three years after filing the return on which they reported the transaction. Generally, the IRS recommends keeping copies of tax returns and supporting documents at least three years. As people are filing their taxes, the IRS reminds taxpayers to hang onto their tax records.

0 kommentar(er)

0 kommentar(er)